| IPO Date | April 28, 2025 to April 30, 2025 |

| Price Band | ₹304 to ₹321 per share |

| Lot Size | 46 Shares |

| Minimum Investment | ₹14,766 |

| Tentative Allotment | Fri, May 02, 2025 |

| Tentative Listing Date | Tue, May 6, 2025 |

| Live Subscription Figures | Click here |

Ather Energy Limited is launching its Initial Public Offering (IPO) comprising a fresh issue aggregating up to ₹2,626 crore and an offer for sale (OFS) of up to 1.10 crore equity shares. While the price band is ₹304 to ₹321 per share and the lot size is 46 Shares, the IPO will be conducted via the Book Building Process with a proposed listing on both NSE and BSE. As per SEBI regulations.

Business Overview

Founded with a vision to drive sustainable mobility, Ather Energy designs, manufactures, and markets electric two-wheelers and associated charging infrastructure. Known for its high-performance electric scooters—Ather 450X and 450S—the company has established itself as a frontrunner in India’s EV segment. Ather also operates a nationwide public charging network called Ather Grid, currently spanning over 1,500 fast-charging points across 100+ cities .

Company Services

Ather’s offerings extend beyond vehicle sales to include post-sales service, connected mobility features via mobile apps, and financial services such as vehicle loans and leasing. Their subscription-based connected services include ride statistics, navigation, theft alerts, and OTA updates—integrating software and mobility into a seamless ecosystem .

Customers

Ather’s customer base primarily includes urban two-wheeler riders who are environmentally conscious and technologically inclined. The company has strategic collaborations with entities like Hero MotoCorp (a significant shareholder) and a growing retail presence through Ather Space experience centers .

Financials

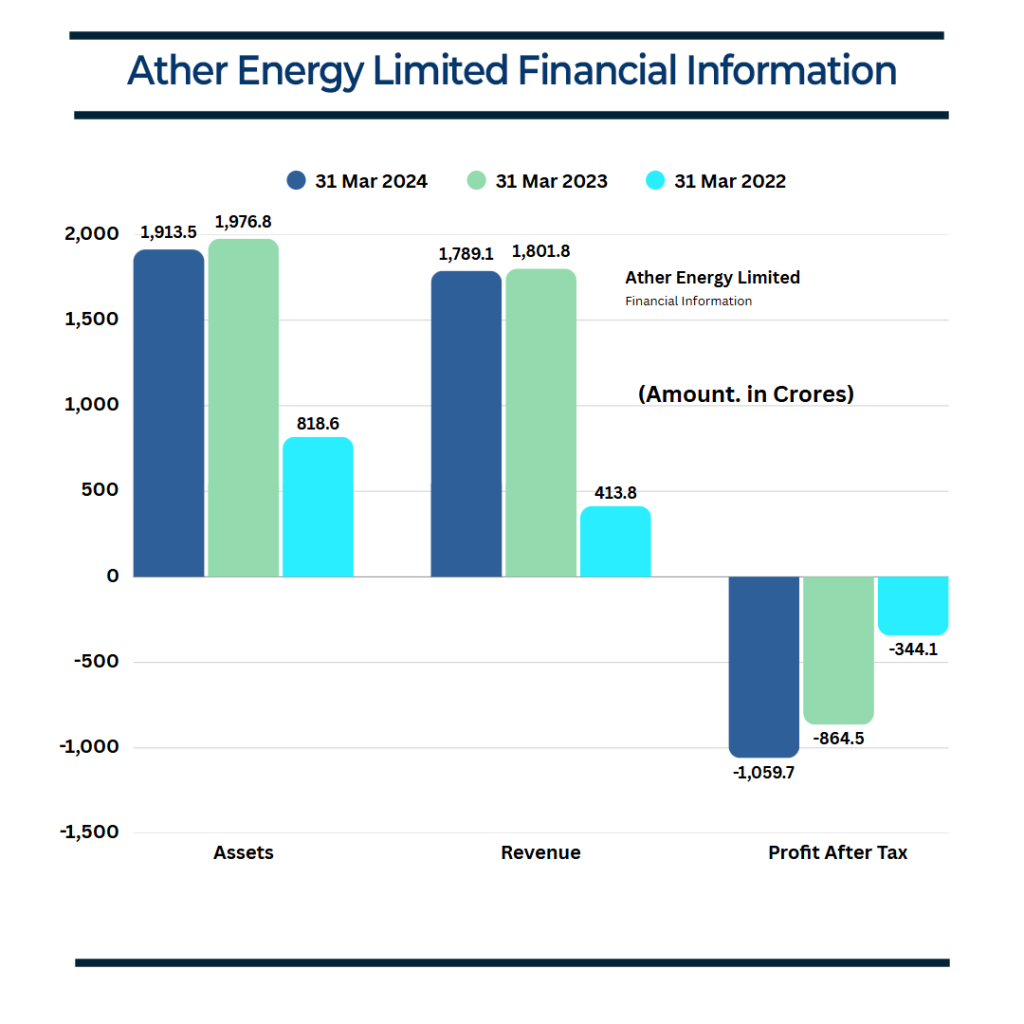

Ather Energy has demonstrated substantial revenue growth over the last three financial years, reinforcing its position as a key player in India’s electric mobility sector. The company’s revenue from operations rose from ₹413.8 crore in FY 2021–22 to ₹1,801.8 crore in FY 2022–23—an impressive year-on-year growth of approximately 335%. In FY 2023–24, revenue marginally dipped to ₹1,789.1 crore, reflecting a plateau following two years of aggressive expansion. Despite this minor decline, the top-line performance remains robust, especially considering the reduction in government subsidies under the FAME II scheme. On the flip side, Ather’s net losses expanded significantly over the same period, from ₹344.1 crore in FY22 to ₹864.5 crore in FY23, and further to ₹1,059.7 crore in FY24. These losses stem from high R&D spending, marketing expenses, network expansion, and the launch of new models such as the 450S and Rizta series. However, the company has shown operational improvements, with EBITDA margins improving from –62% in FY22 to –36% in FY24. This margin recovery indicates early signs of operating leverage, although breakeven remains a medium-term goal. Overall, Ather is walking a tightrope—balancing rapid growth with high capital burn—and the IPO proceeds are expected to play a critical role in funding this transition towards financial sustainability

Valuations

As per recent private placements, the weighted average cost of acquisition for shares was ₹154.40 in the last three years. A significant premium is expected in the IPO, reflecting high growth prospects .

Assets and Reserved Assets

As of FY 2023, Ather reported total assets of ₹1,644.6 crore. These include plant & equipment, R&D infrastructure, and IP-linked intangible assets, positioning it well in India’s fast-evolving EV landscape

Debt Details

Ather’s total borrowings as of Feb 2025 were ₹533.6 crore, with interest rates around 14.5–14.85%. The company plans to utilize ₹40 crore from the IPO proceeds to repay part of this debt, reducing interest outflow and improving balance sheet strength.

Promoter Shareholding

Before the IPO, promoters held 51.8% of the company: Hero MotoCorp (38.19%), Tarun Mehta (6.81%), and Swapnil Jain (6.81%). Post-issue shareholding will dilute, but exact figures will depend on final allotment.

To #Applyipo : https://eipo.aftertrade.in

Follow on our social media pages to get more updates