Open demat account online

Start your investment journey today !

Open Your Demat Account in Few Steps

step 1

Verify mobile & email

step 2

verify pan & bank details

step 3

click live photo

step 4

esign documents

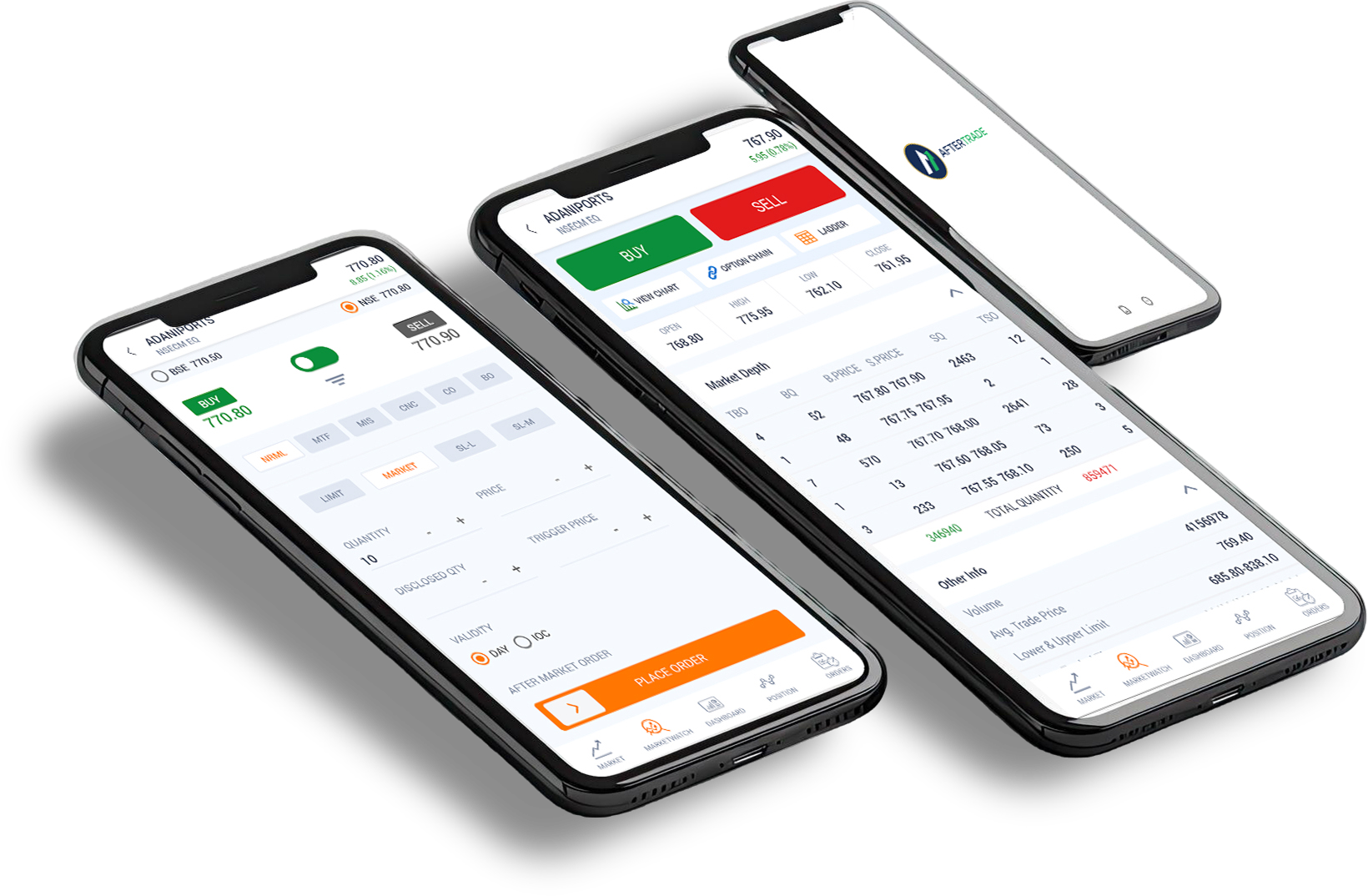

App Features

Fund Transfer

Transfer funds instantly to your Aftertrade account at no charge. Easy peasy!

Pay off graph

The graphic illustrates the highest potential profit/loss when choosing call and put options.

Different Views of Market

Check out our cool portfolio views: List View, Card View, and Heat Map View. Switch it up and see it all!

Option Chain

Option chain tool shows a detailed list of available options for a stock or index.

Multi Sector wise Dashboard

Take a peek at the live sensex and nifty rates, along with cool heat maps, showcasing sectors' epic performances.

Backoffice reports

Enhanced backoffice reports like Ledger, Tax P&L, Holding Statement, Contract Note - all conveniently accessible in one place.

Trading Charges FAQ

For Intraday trades across any segment (Equity, F&O, Currency), we charge ₹11 per executed order.

For Equity Delivery trades, the charge is just ₹1 per executed order.

No, there are no additional charges beyond the brokerage per executed order. You are charged ₹11 per executed order for intraday trades across any segment and ₹1 per executed order for equity delivery trades, regardless of how many trades you place in a day.

All other statutory charges like STT, exchange fees, GST, and SEBI charges will be applicable as per regulations.